For many companies, especially small businesses, the thought of trying to determine indirect costs for an award is daunting. Some of the most frequently asked questions coming from Federal award applicants or recipients are about determining indirect costs. However, as with most things, indirect costs are not as intimidating once you have a better understanding of the process. Here we attempt to demystify indirect costs, with a focus on National Institutes of Health (NIH) grants; we will discuss indirect costs for Department of Defense (DoD) contracts in a separate article; however, and fortunately, there is overlap for determining indirect cost (IDC) rates. However, and as with any professional services, please consult with an expert on IDC rate negotiation and other accounting requirements as needed.

The NIH National Institute of Allergy and Infectious Diseases (NIAID) offers helpful guidance on Understanding Indirect Costs, as well as a YouTube presentation called Indirect Costs 101, presented by Dr. Sally Rockey, the NIH Deputy Director for Extramural Research. The NIH’s Office of Acquisition Management and Policy (OAMP) Division of Financial Advisory Services (DFAS) Indirect Cost Branch also provides guidance on submitting Indirect Cost Proposals.

For colleges/universities, non-profits, hospitals, and state and local governments, the IDC rates are negotiated and established in good faith by cognizant Agencies other than NIH. This determination, referred to as “cost negotiation cognizance,” is set by the Department of Health and Human Services (HHS) Division of Cost Allocation or Department of Defense’s (DoD) Office of Naval Research (ONR). A project’s IDC rate will be set by the agency the grantee is receiving the most funding from (i.e., either HHS or DoD). If most your funding award is of NIH origin, HHS Cost Allocation Services (CAS) site is the place to start (a new website is in process). If the majority of your grant funding award is from the DoD, ONR is the place to start (under Indirect Cost Rate Administration and Audit Resolution).

For for-profit small business concerns (SBC) and for-profit organizations, the IDC rates are established by the NIH. In these cases, the Division of Financial Advisory Services (DFAS), Office of Acquisition Management and Policy (OAMP) will set the rate for the grantee organization. IDC rate structures and the negotiating process for commercial organizations is discussed in more detail below.

Once a federally-funded rate is negotiated and established, it applies to all government funding agencies that are going to support the grantee institution. Uniform Guidance released in 2014 explained that Federal Agencies must accept and apply negotiated IDC rates to all federal awards, grants, and cooperative agreements, and are not typically required to adhere to a rate cap (except when a rate cap is required by a statute or is approved by the awarding federal agency head).

Direct vs. Indirect Costs

Direct costs can be easily identified or assigned to a specific research project and include items such as direct salaries and wages, materials, supplies and equipment, consultants and subcontractors, and travel expenses.

Indirect costs (also referred to as “facilities and administrative costs” or “F&A costs”) are infrastructure costs that are not directly related to the project itself but are required to conduct the research and are critical to the success of the project and organization as a whole. Indirect costs include fringe benefits, overhead costs, and General and Administrative (G&A) costs.

- Fringe Benefits are allowances and services provided to employees, such as paid absences (vacation, holiday, and sick leave), payroll taxes, pension plans, and group insurance (health, life, and disability).

- Overhead Costs are indirect costs relating to the performance of a project, such as overhead labor (e.g., supervision, general meetings), fringe benefits on overhead labor, facility costs and depreciation, and general laboratory supplies.

- General and Administrative (G&A) Costs are indirect costs associated with the overall management of the company, such as executive and administrative labor, fringe benefits on G&A labor, professional fees (e.g., CPA), and office supplies.

The total costs requested in your budget will include allowable direct costs (related to the performance of the grant) plus allowable indirect costs. If awarded, each budget period of the Notice of Award will reflect direct costs, applicable indirect costs, and in the case of SBIR/STTR awards, a “profit” or fee (e.g., 7%).

NIH and DoD typically specify the funds available for awards in direct costs in order to maximize fairness and competitiveness in peer review, allowing reviewers to judge applications’ science in the context of comparable costs (e.g., direct costs). NIH will not grant requests ≥ $500,000 per year in direct costs without prior approval from the NIH Institute/Center before application submission. When calculating whether your direct cost per year is $500,000 or greater, do NOT include any sub-recipient indirect costs in the base, but do include all other direct costs as well as any equipment costs.

Indirect Cost Rates

Indirect cost rates are needed to provide a uniform method for funding and charging indirect costs and to provide an equitable allocation of indirect costs across all projects. The IDC rate is a ratio between indirect costs (pool) and an equitable base.

Indirect costs are determined by applying your organization’s negotiated IDC rate to your direct cost base.

For most institutions, the negotiated IDC rate will use a modified total direct cost (MTDC) base, which excludes items such as equipment, student tuition, research patient care costs, rent, and sub-recipient charges (after the first $25,000). For many SBIR/STTR programs, 40% of MTDC is a common IDC rate, although rates at organizations may vary. In instances where the grantee institution does not have a negotiated rate at the time of its award and it does not wish to pursue negotiations to establish one, it can elect to receive a “de minimus” rate, which is 10% of MTDC. If the grantee institution does elect to use the de minimus rate, such rate must be used for all federal awards granted to that grantee institution, unless it chooses to negotiate for a rate, which it may apply to do at any time.

NIH provides F&A (indirect) costs without the need for a negotiate rate for certain classes of award, including training, education, and career development grants, as well as foreign or international organizations and domestic grants with foreign components, at a rate of 8% of MTDC.

There are three types of IDC rates:

- Provisional Rates – Based on projections for the current fiscal year and are used for funding and charging.

- Final Rates – Based on actual costs and charges are adjusted to reflect final rates.

- Ceiling Rates – Final rates cannot exceed ceiling rates.

Indirect Cost Rate Structures

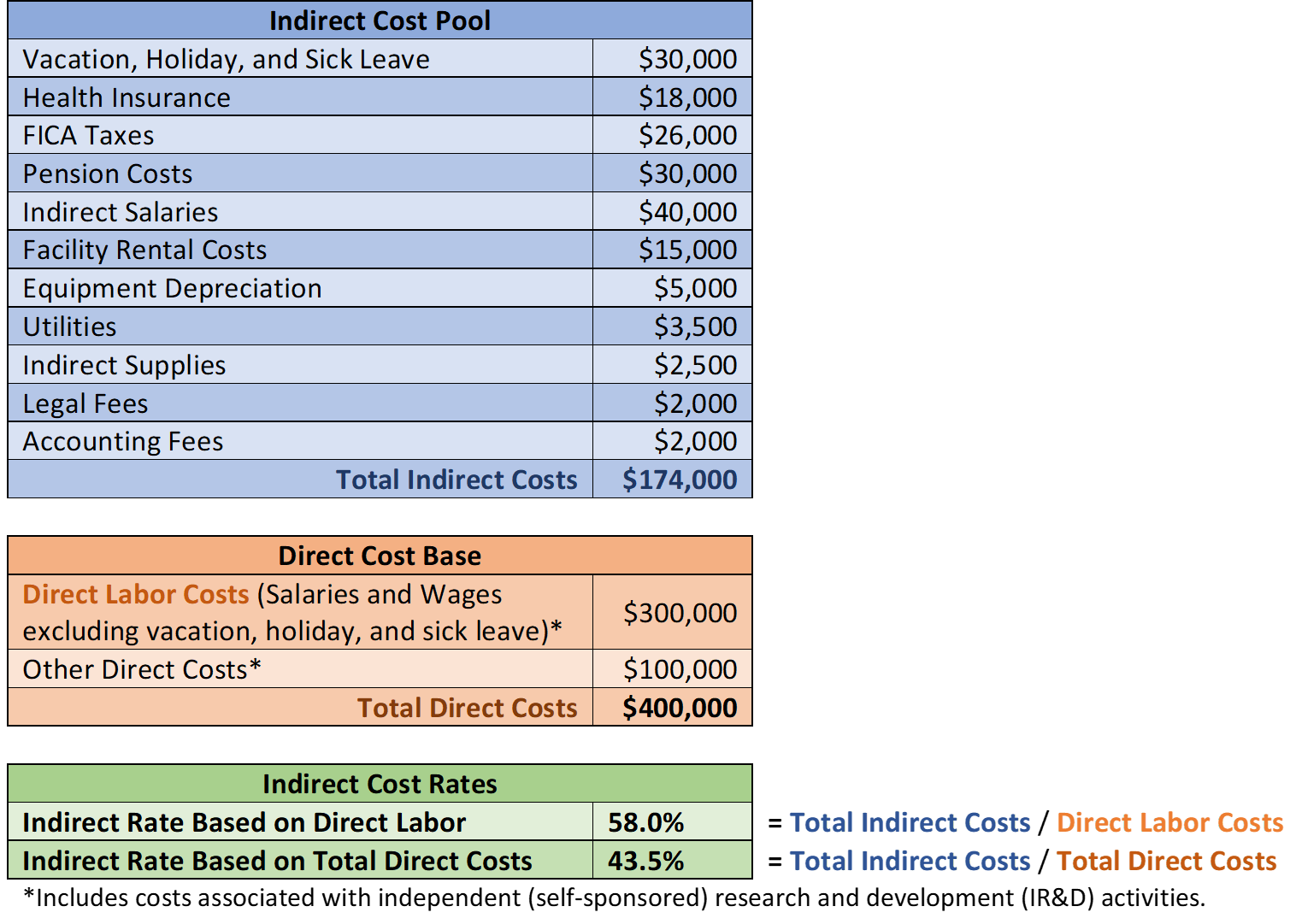

Generally, IDC rate structures for commercial organizations follow a single, two-rate (e.g., fringe and overhead rates), or three-rate (e.g., fringe, overhead, and G&A expense rates) system. The OAMP DFAS provides the following example of a single-rate structure:

DFAS also provides Excel Workbooks with examples for completing Two-Tier and Three-Tier IDC Rate Systems.

Unallowable Costs

NIH research funding supports both direct and indirect costs associated with research, however, costs for non-research activities (e.g., instructional activities) must be explicitly separated since NIH negotiates the IDC rate based on the costs associated with research activities only. Additionally, facilities costs are also limited to the spaces that will be used only for research. Separating activity costs ensures that reimbursements issued on grants solely support the conduct of research.

While often legitimate costs, unallowable costs are costs related to doing business that the government won’t reimburse as part of a federal contract. Unallowable/unallocable costs for the NIH are listed below. The Indirect Cost Branch provides more information on these costs as well as the related FAR citation for each.

- Advertising Costs • Legislative Lobbying Costs

- Bad Debts Costs • Organization Costs

- Compensation for Personal Services • Patent Costs

- Contingencies • Relocation Costs

- Contributions or Donations • Royalty Costs

- Entertainment Costs • Taxes

- Fines and Penalties • Travel Costs

- Insurance Costs • Alcoholic Beverage Costs

- Interest and Other Financial Costs

IDC Rate Negotiating Process

As mentioned above, IDC rates for commercial (i.e., for-profit) small businesses and organizations are established by the NIH’s Division of Financial Advisory Services (DFAS). If your company has/will not elect to simply use a de minimus rateof 10% MTDC, the following steps will help guide you through the IDC rate negotiation process.

Step 1: Contact the Indirect Cost Branch

NIH’s DFAS Indirect Cost Branch negotiates IDC rates with commercial companies which receive the majority of their federal awards from the HHS. Companies should contact the Indirect Cost Branch when notified that a grant is going to be awarded. The Indirect Cost Branch will need the following information:

- Representative Name and E-mail Address

- Company Name and Address

- Grant Number

- Grant Specialist’s Name

Step 2: The Indirect Cost Proposal

The Indirect Cost Branch will then send a request via email for the company to submit an Indirect Cost Proposal.

Companies with federal contractexpenditures, or subcontract expenditures under a federal contract in a particular fiscal year under flexibly-priced contracts (e.g., Cost Plus Fixed Fee, etc.), should provide all applicable final IDC rate data as specified in the Federal Acquisition Regulation (FAR) 52.216-7(d)(2)(iii) for that year. Alternatively, these companies may submit the Defense Contract Audit Agency’s (DCAA) requirements for incurred cost submissions entitled the Incurred Cost Electronically (ICE) Model for that particular year.

Companies with non-contract federal expenditures or subaward expenditures under a federal award (such as a grant or subgrant) should submit an information package (Infopack). The IDC proposal should be based on company-wide cost data and should be accompanied by the Indirect Cost Submission Checklist, which includes:

- Cover Letter: Specify the company’s current address, EIN and DUNS numbers, how long the company has been in business, fiscal year accounting period, and the IDC rates that you are requesting.

- Prior Federal Reviews: Has the organization ever had rates reviewed by another Federal Agency?

- CAS Covered Contracts: Does the company have contracts subject to “Full” or “Modified” CAS coverage? Cost Accounting Standards (CAS) are a set of nineteen standards promulgated by the Cost Accounting Standards Board (CASB) designed to ensure uniformity and consistency in the measurement, assignment, and allocation of costs to contracts with the U.S. Government. CAS covers a variety of costs such as depreciation, pension plans, personal compensation, indirect costs, and other areas of accounting.

- Organization Review: Provide a copy of the company’s organization chart specifying which units are indirect (administrative) functions of the organization. Also provide a narrative explaining the various products and services the company provides, as well as the functions of each major business unit in the company.

- Financial Statements: Provide copies of financial statements (audited statements preferred) for your most recently completed fiscal year.

- Salary Distribution Schedule: Provide a detailed salary distribution schedule for each fiscal year in which you are seeking rates. A sample salary distribution schedule here.

- Company’s Personnel Manual: Provide a copy of the company’s personnel manual.

- Retirement/Pension/Profit Sharing Plans: Are Retirement/Pension/Profit Sharing costs included in the proposal?

- Paid Absences (e.g., vacation, holiday, and sick leave): Provide a copy of the company’s leave policy and a description of how the company charges paid absences to projects/cost objectives.

- Bonuses: Have the costs of bonuses been included in the IDC proposal?

- Leases with Related Parties: Does the company lease with a related party (e.g., owner, stockholder, or an affiliate)?

- Off-Site Locations: Are any contracts/grants performed at a customer-owned, off-site location?

- Professional/Consultants/Outside Services: Have professional fees (e.g., legal and accounting), consultants (e.g., scientific), or outside services (e.g., administrative) been included in the IDC pool?

- Independent (self-sponsored) Research & Development (IR&D): Does the company have IR&D costs?

- Human Embryonic Stem Cells: Does the company perform research on human embryonic stem cells?

- Accounting System/Internal Control Questionnaire

- Miscellaneous Income: Does the company have any miscellaneous income (e.g., rental income)? Provide a listing of the categories of expenses normally classified and charged as direct costs on contracts, grants, and other projects.

- Direct Cost Categories Listing: Provide a listing of the categories of expenses normally classified and charged as direct costs on contracts, grants and other projects.

- Executive Compensation Schedule: Prepare a completed Executive Compensation Schedule.

- Certificate of Final Indirect Costs: If your Indirect Costs Submission covers final (actual) indirect cost rates, provide a completed Certificate of Final Indirect Costs.

- Audit Requirements of For-Profit Organizations: Read and write in the comments/attachment column the date read along with your initials to signify that you fully understand the audit requirements.

- Schedule of Federal Awards: For each year in which you are seeking rates, provide a detailed schedule of all Federal awards (grants and contracts) that were active during the year(s) in which you are seeking rates (one schedule for each year).

- Audit Report Submission Date: For each fiscal year covered by this checklist with HHS expenditures (listed in response to #22 above) that met the HHS audit requirement threshold ($750,000 for company fiscal years ending on or after 12/26/2014) indicate the date the required audit report was submitted to the National External Audit Review Center.

Step 3: Submission and Review of the IDC Proposal

Once the Indirect Cost Proposal is submitted, the Indirect Cost Branch will review the proposal and follow-up with the company to have any questions answered.

Step 4: Rate Negotiations

Rate negotiations between the company and the Indirect Cost Branch typically occur over the phone. A Rate Agreement is then issued, or a rate memo/letter is sent to the grant specialist.

IDC Negotiations in eRA Commons

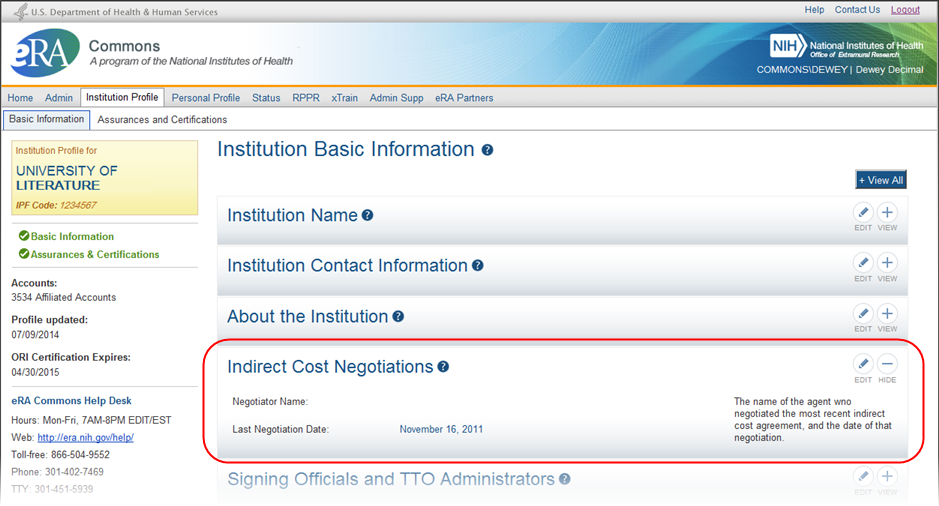

If you’ve submitted a grant application to NIH, you should have an electronic Research Administration (eRA) Commons account. The Institution Basic Information component of the Institution Profile includes an Indirect Cost Negotiations section which allows you to view your organization’s Negotiator and Last Negotiation Date. You can only edit this information if you hold the Signing Official (SO) role within an organization (e.g., President or CEO). The eRA Commons User Guide provides additional information on eRA Commons modules and user roles.

Total Cost Awards (TCA)

Total Cost Awards (TCA) provide grantees with a previously determined funding level for an award, regardless of the IDC rate, meaning the funding Federal Agency can provide a total available award amount up front. However, the grantee will need to work backwards and determine which portions of the award can be spent on indirect and direct costs. Although TCAs tend to be easier for the funding agency to budget, investigators often misjudge the amount of money available to complete their research. Because of this, TCA grants from NIH are rare and they prefer to specifically list the amount of the award designated to direct and indirect costs.

What’s Next?

Indirect costs can be a challenging and costly process for small business concerns (#SBC), so if you have suggestions for NIH, DoD, and other Federal Agency IDC Rate Negotiation Agreement processes, additional resources (like Dr. Rockey’s helpful presentation above for Colleges and Universities and SBC-focused training), or access or experience with reasonably priced accountants with this IDC negotiation expertise/experience, please share in the comments below.